Income Generation Loans

Group Loans

Individual Loans

Income Generation Loans

Group Loans

Individual Loans

Who We Are

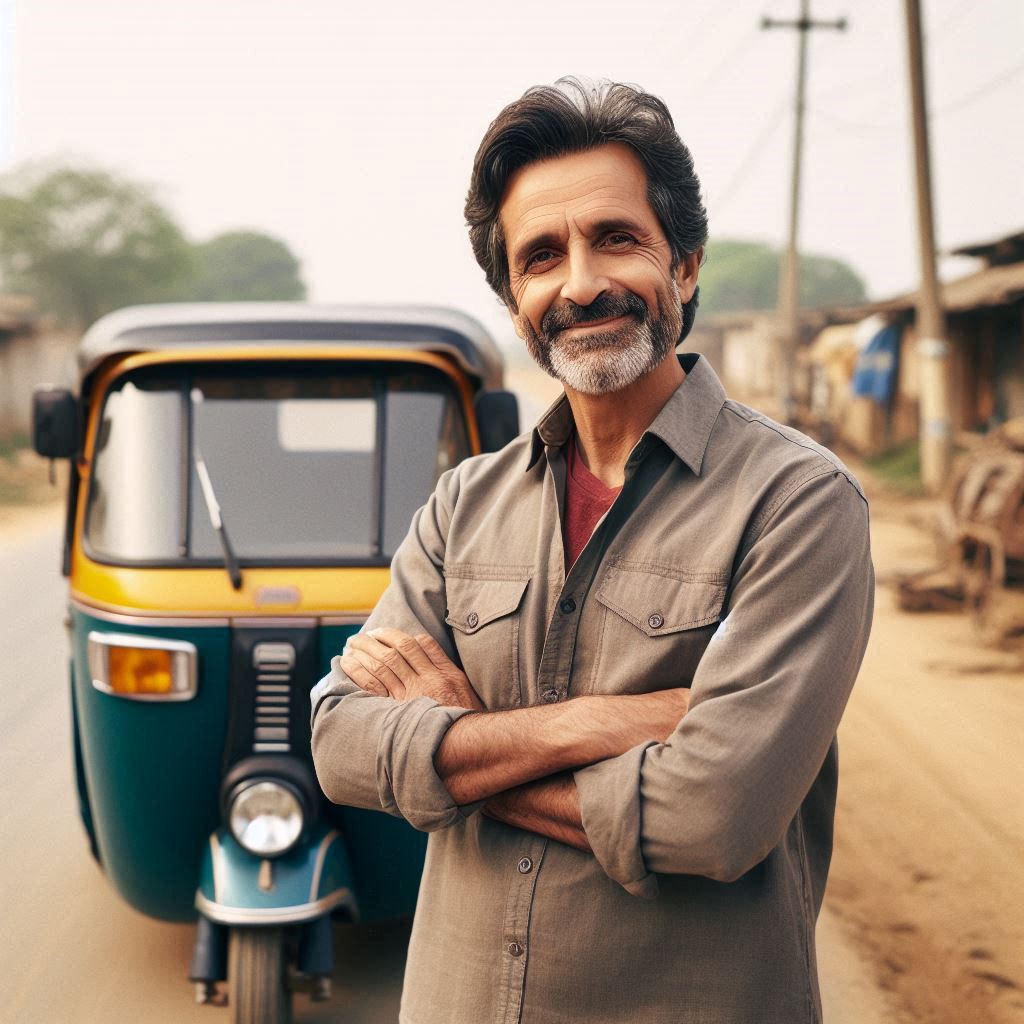

DEV Maharaj Microfinance Foundation is a private Indian non-government organization committed to empowering underserved and low-income communities. We offer accessible microfinance services that promote income generation, entrepreneurship, and long-term financial inclusion. Our goal is to help individuals build sustainable livelihoods by providing responsible financial support. Through our initiatives, we aim to foster economic development, improve living standards, and encourage self-reliance in rural and semi-urban areas across India. We believe financial access is key to social and economic transformation.

23040

Active Loans

8

Branches

4

States

200

Employees

3427

Total AUM (₹M)

Empowering Income Generation

At DEV Maharaj Microfinance Foundation, we enable individuals to generate sustainable income through responsible microfinance services. Whether it’s starting a small shop, purchasing livestock, or launching a home-based business — we make entrepreneurship possible.

Women Entrepreneurs

Micro-loans help women start tailoring, beauty, or handicraft businesses — fostering independence an...

Rural Shops & Services

We fund small shops, tea stalls, and vendors in rural areas — creating local jobs and meeting daily...

Livestock & Agriculture

Our financial support helps families invest in livestock or farming tools, improving food security a...

What Our Clients Say

Why Choose DMMF?

We believe financial inclusion is the key to self-reliance, offering more than loans — we provide trust and opportunities for underserved communities.

Common Questions

Our Latest Insights

What is Microfinance and How Does It Work?

Microfinance provides small loans to individuals or groups who do not have access to traditional banking. Learn how it empowers local businesses and women entrepreneurs.

What is Microfinance and How Does It Work?

Microfinance provides small loans to individuals or groups who do not have access to traditional banking. Learn how it empowers local businesses and women entrepreneurs.

What is Microfinance and How Does It Work?

Microfinance provides small loans to individuals or groups who do not have access to traditional banking. Learn how it empowers local businesses and women entrepreneurs.